Unlocking Property Value: What Lies Beyond the Price Tag?

Introduction:

When considering a property investment, the listed price is just the tip of the iceberg. Understanding the factors that truly drive property value can help you make a more informed decision and potentially uncover hidden opportunities. While common factors like location, job prospects and infrastructure are common factors and are essential, there’s more beneath the surface that influences property prices in unexpected ways.

1 : Location and Neighborhood Analysis: More Than Just a Pin on the Map

- Micro-location factors:

- Proximity to business districts, schools, and healthcare facilities

- Public transportation accessibility

- Safety and crime rates

- Neighborhood characteristics:

- Social infrastructure and community facilities

- Green spaces and recreational areas

- Demographic profile of residents

2: Infrastructure and Amenities

- Existing infrastructure:

- Quality of roads and connectivity

- Availability of utilities (water, electricity, internet)

- Presence of shopping centers and entertainment options

- Upcoming developments:

- Planned infrastructure projects (metros, highways)

- Proposed commercial developments

- Government initiatives for area development

3. Future Development Plans

- Urban planning insights:

- Master plans for the city or region

- Zoning regulations and potential changes

- Smart city initiatives

- Economic growth indicators:

- Job market trends in the area

- Upcoming business parks or SEZs

- Foreign direct investment in the region

4. What Lies Beyond: Understanding Some Real Hidden Factors

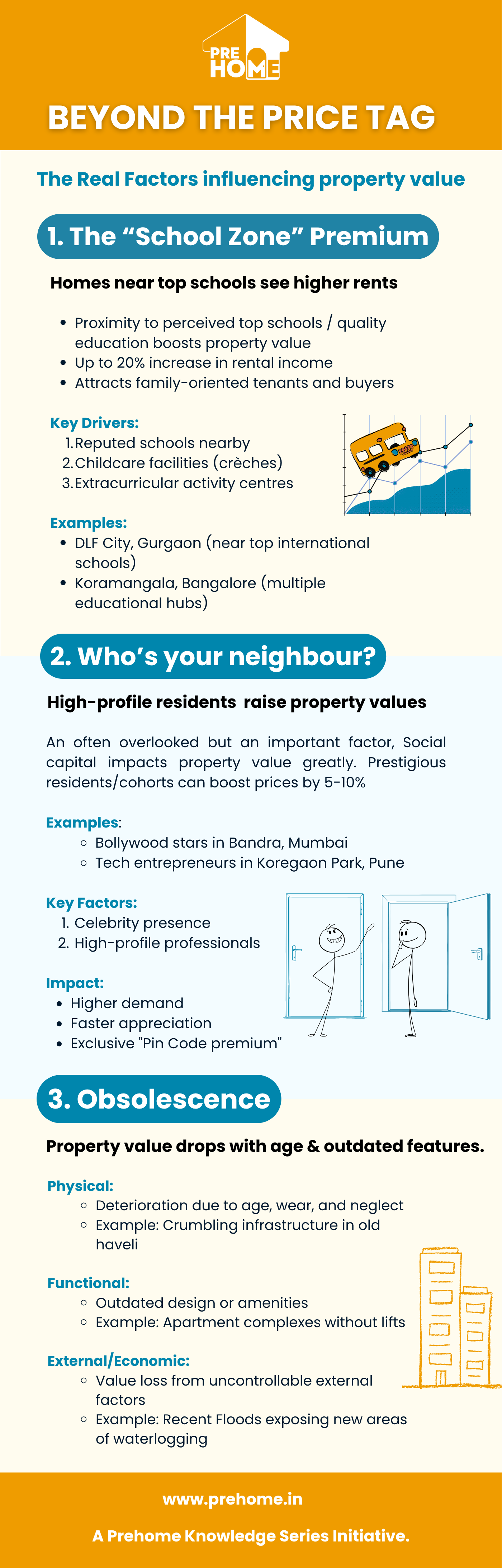

- While factors like location and infrastructure are the backbone of property value, there are intangible elements that go beyond what meets the eye, as shown in our infographic:

- School Zone Premium: properties near reputed educational institutions can command up to 20% more value. It’s not just about the convenience; it’s about attracting family-oriented buyers and tenants who place a premium on education.

- Social capital: The presence of celebrities, industry leaders, or even established community hubs can significantly drive up demand and prices in a given area.

- Obsolescence: Physical or functional obsolescence can drag property values down, making it crucial to assess a building’s long-term viability, not just its current state.

Conclusion:

The true value of a property extends far beyond its current price. By considering factors like location, infrastructure, and future development plans, you can gauge a property's potential for appreciation and livability. This holistic approach to property evaluation can help you identify opportunities that align with both your immediate needs and long-term financial goals.

In our next blog, we'll explore how to assess a property's potential for appreciation, helping you make a decision that balances current value with future prospects.