Real Stories, Real Outcomes: What Rent-to-Own Looks Like When It Works

- By now, you’ve seen the full framework of Rent-to-Own:

- Blog 28: The basics of RTO and why India needs flexible ownership options

- Blog 29: The legal and documentation principles that keep RTO safe and enforceable

But understanding the model is one thing. Seeing how it changes real lives is another

Rent-to-Own is still growing in India, but globally it has helped thousands bridge the gap between renting and owning.

This final blog brings together real-life stories, global trends, and practical lessons to help readers see themselves in the journey.

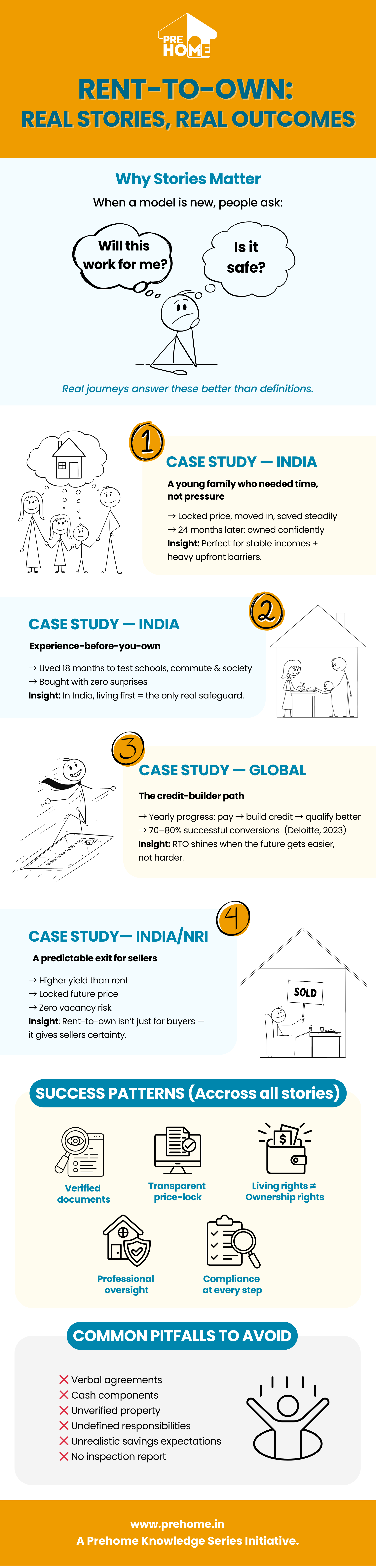

1. Why Stories Matter When The Model Is New

- When a concept is unfamiliar, people naturally ask:

- “Will this work for someone like me?”

- “Is it safe?”

- “What if something goes wrong?”

- “How do I know I’m not making the wrong decision?”

Stories answer these questions through lived experience — they show what data cannot.

2. Case Study 1 (India): The Young Family Who Needed Time, Not Pressure

- Profile:

- Couple working in Gurgaon

- Combined income: ₹22 lakh (but sporadic since they had started their own firm)

- Looking at a 1.2 crore home

- EMIs were manageable, but the ₹24 lakh down payment was not

- What they did:

- Chose a verified 3BHK through a structured Rent-to-Own model

- Locked a fair future price

- Moved in immediately

- Built savings over 24 months

- The outcome:

- Rental inflation no longer affected them

- Their savings stayed ahead of home price movement

- They transitioned into ownership smoothly

- No pressure, no buyer’s remorse, no frantic down payment scramble

- The insight:

- Rent-to-Own works exceptionally well for households with stable income but heavy upfront barriers.

3. Case Study 2 (India): The “Experience Before You Own” Journey

- Profile:

- Family relocating to Gurgaon from Delhi

- Unsure about:

- Schools

- Commute

- Society culture

- Locality safety

- Noise levels and natural light

- What they did:

- Used a structured RTO pathway to live in the home for 18 months

- Tested everything in real life

- Evaluated whether the home fit their future

- The outcome:

- Their eventual decision was based on real experience, not a sample flat

- 18 months later, they bought confidently

- Zero surprises and zero regret

- The insight:

- In India, where sample flats rarely reflect reality, “live before you buy” is not a luxury — it’s a safeguard.

4. Case Study 3 (Global): The Credit Builder Success

- In the US and Canada, Rent-to-Own is commonly used by families building creditworthiness. A Deloitte 2023 housing brief showed:

- Structured RTO programs have 70–80% successful conversions

- Most participants improve their credit score while renting

- Clear price locks reduce anxiety around rising markets

- A typical journey looks like this:

- Year 1: Build credit history through consistent payments

- Year 2: Improve financial documentation

- Year 3: Qualify for a mortgage at a better rate

- The insight:

- RTO works best when the future goal (a mortgage) becomes easier over time — not harder.

5. Case Study 4 (India/NRI): The Predictable Exit Strategy

- Profile:

- NRI homeowner in Dubai

- Owned a 2BHK in Pune

- Wanted to sell but didn’t want low-ball offers or market uncertainty

- What they did:

- Entered a structured RTO agreement with a 2-year window

- Received higher yield than traditional rent

- Locked a future exit price

- Avoided negotiation fatigue

- Eliminated the risk of unplanned vacancy

- The outcome:

- Predictable sale

- Predictable yield

- Zero micro-management

- No distress sale

The insight:

RTO is not only a buyer-friendly model. When done professionally, it is equally powerful for sellers who value predictability.

6. Patterns Across Successful Rent-to-Own Journeys

- Across India and global markets, the most successful RTO stories share five traits:

- Transparent pricing: No ambiguity, no verbal commitments, no surprises.

- Documentation clarity: A clear separation of today’s living rights and tomorrow’s purchase rights.

- Realistic savings and affordability planning: The model works best when buyers build savings steadily rather than hurriedly.

- Verified, curated properties: Unverified properties are the biggest source of disputes — which is why RTO must begin with vetted homes (Blog 28).

- Professional inspections: Globally, every structured RTO model uses pre-move-in condition reports to ensure fairness.

These patterns validate the strength of structured pathways versus informal arrangements.

7. Common Pitfalls and How to Avoid Them

- Even though structured RTO is robust, the informal versions can be risky. Here are the pitfalls seen across markets:

- Choosing the wrong home: Rushing into a home that doesn’t match long-term needs often derails the journey.

- Verbal agreements: India’s courts do not enforce verbal price locks.

- Lack of clarity on responsibilities: Repairs, maintenance, and society dues must be clearly allocated.

- Unrealistic savings expectations: RTO provides time, not a shortcut. Savings discipline still matters.

- Ignoring documentation quality: Unregistered agreements or unverified titles can lead to disputes.

- Engaging without structure: The model only works when implemented professionally.

8. A Simple Home Seeker Checklist for Anyone Considering Rent-to-Own

- Before entering an RTO arrangement, ensure:

- Property documents verified

- Future price clearly written and agreed

- Contribution structure understood

- Responsibilities clearly defined

- Payment trail digital and transparent

- No cash components

- Clear purchase window timeline

- Pre-move-in inspection completed

- Clear exit terms

This checklist alone eliminates 90% of the risks seen in informal arrangements.

The Final Word: The Future of Flexible Homeownership

Rent-to-Own is not about replacing renting or buying. It’s about recognising a simple truth:

Homeownership in India needs more flexible pathways — pathways aligned with today’s financial realities, mobility, and aspirations.

- Across the three blogs in this topic, we explored:

- Blog 28: How RTO works and why India needs it

- Blog 29: The legal framework that keeps it safe

- Blog 30: How real families and homeowners use it successfully

As India evolves, so will the ways we own homes. Rent-to-Own is not just a bridge — it is a plan for a new type of housing mobility and financial planning.