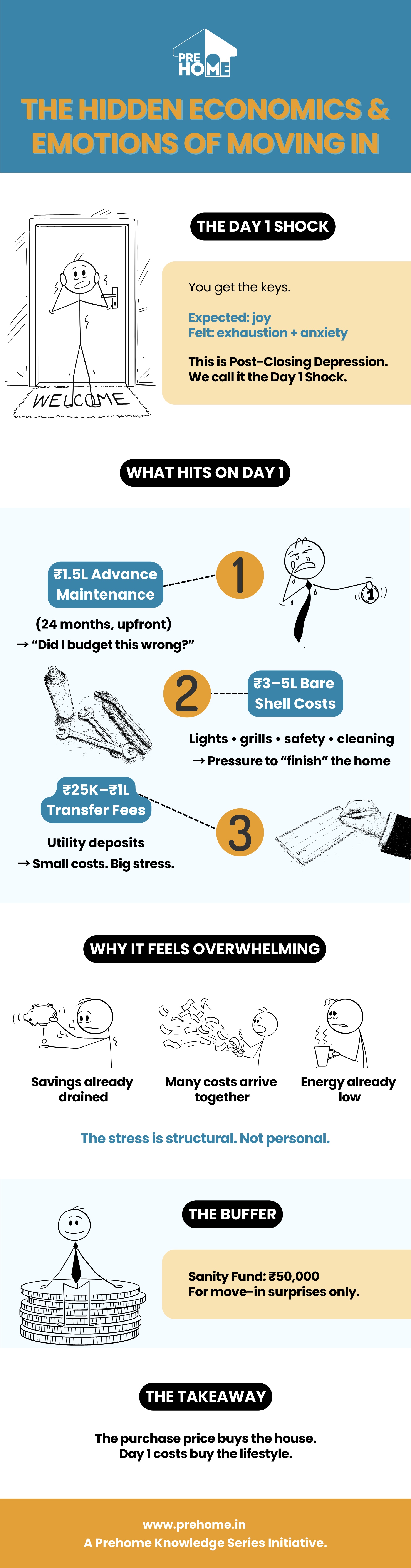

The "Day 1" Shock: The Financial & Emotional Cost of Moving In

The keys are in your hand. You expected to feel joy. Instead, you feel… exhausted? You are not alone. Psychologists refer to this as "Post-Closing Depression" . After the excitement of searching for a home and the stressful loan process, your energy crashes. Just as your mental energy drops, your finances face a big challenge.

We call this the "Day 1 Shock" . It's the clash of unexpected costs and emotional exhaustion.

1. The "Advance Maintenance" Anxiety

- You just emptied your savings for the Down Payment (Topic 2). You feel financially fragile.

- The Shock : The builder demands ₹1.5 Lakhs (24 months maintenance) upfront.

- The Psychology : This often triggers "Buyer’s Remorse"—that sinking feeling of “Did I budget this properly?”

- The Reality : This is normal. It doesn’t mean you made a mistake; it just shows that the system requires upfront payments.

2. The "Bare Shell" Stress

- You walk into your "Dream Home" and it echoes. It feels cold.

- The Cost : Grills, lights, cleaning, and safety doors will cost ₹3–5 Lakhs.

- The Mental Toll : You feel pressured to make it "Instagram perfect" right away. This is the "Diderot Effect," where one new purchase (the home) leads to a series of other purchases (furniture, decor) you aren’t ready for yet.

- The Fix : Live with the basics. It’s okay to leave some rooms empty for a year.

3. The Hidden "Transfer" Taxes

- Society transfer fees (₹25k–₹1L) and utility deposits (₹10k) feel overwhelming.

- The Insight : Many homeowners find that the most stressful moments don’t come from large expenses but from many small, unexpected payments that appear when they’re already feeling drained.

- The Advice : Set aside a "Sanity Fund" of ₹50k just for these hidden costs.

Conclusion:

The "Purchase Price" secures the house. The "Day 1 Shock" pays for the lifestyle. Acknowledge the stress. It’s not just you; it’s part of the process.

Once the initial panic fades, low-grade anxiety kicks in: “What if something breaks?” Let’s replace that worry with a plan.

Next in our series:

Blog 32: "The Anxiety of Decay: Why You Need a 1% Maintenance Fund"