The NRI’s Dilemma – Why Selling Property in India Isn’t as Easy as it Looks

Introduction:

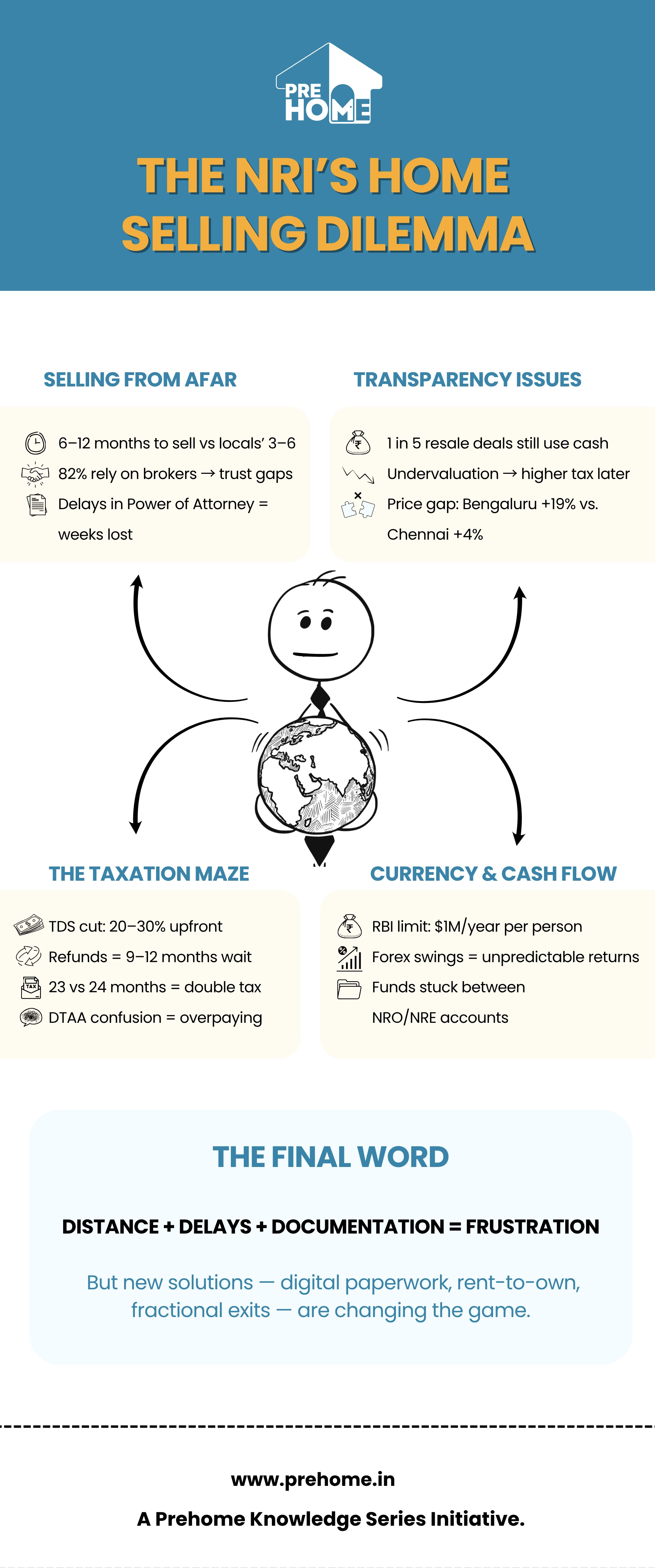

For millions of Non-Resident Indians (NRIs), property in India represents more than just real estate; it connects them to their roots. However, when it is time to sell, the experience can be overwhelming. What seems straightforward on paper—listing, negotiating, transferring—turns into a test of patience, compliance, and trust.

This blog examines the unique challenges NRIs face when selling property in India and why these obstacles often lead them to seek creative alternatives.

1. The Ground Reality of Selling from Afar

Distance complicates everything.

-

- Dependence on others: 82% of NRI property sales involve a local representative or broker (Knight Frank 2023). This reliance often raises transparency issues.

- Delayed timelines: On average, it takes 6–12 months for an NRI to sell a property in metropolitan areas, compared to 3–6 months for local sellers.

- Paperwork delays: Even basic tasks—like notarizing a Power of Attorney from abroad—can take weeks.

If you’ve read our earlier blog on hidden costs of homeownership (Topic 6), you’ll remember how indirect costs can sneak in. For NRIs, these delays become a hidden “cost” of selling.

2. Transparency and Trust IssuesHow Rent-to-Own Works in India: A Step-by-Step Guide

Despite reforms, NRIs still face issues with credibility.

-

- Cash pressures: While demonetization reduced large cash deals, 1 in 5 resale transactions in Tier-2 cities still include informal cash components (CREDAI 2024). NRIs who can’t handle this often miss out on potential buyers.

- Undervaluation risks: Some properties are under-reported in sale deeds to lower stamp duty. This not only reduces the actual sale value but also raises capital gains tax later.

- Information gap: Living abroad, NRIs often lack access to local price trends. For example, Bengaluru experienced an average 19% year-on-year appreciation in 2023, while some areas of Chennai only grew by 4%. Knowing this difference can lead to significant financial losses or gains.

In Topic 7 (Rental Inflation vs. Home Price Appreciation), we looked at how appreciation varies across cities. That same unevenness makes NRIs particularly vulnerable to poor pricing decisions.

3. The Taxation Maze

This is where complexity peaks.

-

- TDS burden: Buyers must deduct 20–30% TDS up front when purchasing NRI properties. If the seller hasn’t planned their taxes, recovering excess TDS can take months.

- Capital Gains Tax: NRIs often misunderstand whether their property qualifies for long-term or short-term capital gains. For example, holding a property for 23 months instead of 24 can double your tax liability.

- DTAA confusion: Many NRIs in the US and Gulf are unsure how Double Taxation Avoidance Agreements apply, leading to either overpayment or risky underreporting.

Quirky Stat: In 2022–23, NRIs sent $119 billion back to India (RBI). A significant portion was related to property sales, yet tax refunds for excess TDS took an average of 9–12 months to process

4. Currency & Repatriation Hurdles

Finally, even after selling, the money doesn’t flow smoothly.

-

- RBI caps: NRIs can repatriate up to $1 million per financial year per person from property sales, subject to proper documentation.

- Forex fluctuations: Currency swings can make or break an NRI’s returns. A weaker rupee benefits those sending money into India, but for those repatriating property sale proceeds out of India, a stronger rupee means higher dollar returns. In 2022, when the rupee fell to 83/USD, many sellers found their repatriated gains worth less abroad, despite selling at higher prices locally.

- Banking friction: Funds often get stuck between NRO and NRE accounts due to incomplete documentation, causing additional delays.

The Final Word

Selling property in India as an NRI involves navigating distance, compliance, and uncertainty, rather than just dealing with real estate. For many, the emotional ties to their property can quickly turn into frustration with the process.

The good news is that the landscape is changing. Digital registries, online documentation, and innovative models like fractional exits and rent-to-own arrangements are offering new options.

In our next blog, we’ll look at smarter exit strategies to help NRIs sell properties faster, safer, and often at better values than traditional methods.

If you missed our last topic on rental inflation versus property appreciation, it’s worth your time—those insights also explain why NRIs should reconsider when to sell their properties.