It's a familiar feeling: you find the perfect apartment, agree on a fair rent, and feel financially secure. Then the annual rent renewal notice arrives. You brace yourself for a small increase, but this time it's 15% or 25%. This isn’t just a random rise; it's rental inflation, and it's affecting millions of people in India. In this blog, the first in our series, we'll explain what rental inflation is, why it happens, and how it poses a significant threat to your long-term financial stability.

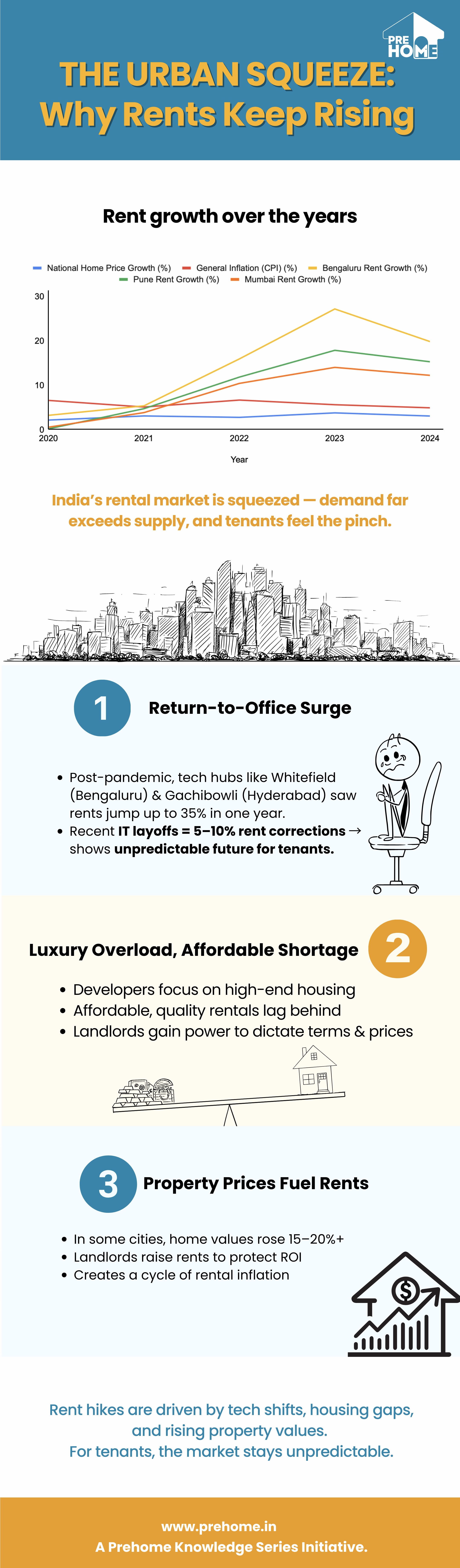

Most companies are offering an average annual salary increase of 9-10%. Meanwhile, rental markets in major cities in India are moving at a different speed. In 2024, rental inflation in key areas of Bengaluru, Delhi, and Hyderabad jumped by 20-30% compared to the previous year. This means your rent is increasing two to three times faster than your salary.

This widening gap undermines your savings and makes it harder to create a stable financial future.

Why are these increases becoming so aggressive? The Indian rental market faces several interconnected challenges, and it's a clear case of demand far exceeding supply.

Understanding rental inflation is the first step to taking control of your financial future. While the rental market is fundamentally unpredictable and subject to these inflationary pressures, there is a way to achieve a more stable future.

Consider this: a property in a major city that rents for ₹35,000 per month may require an EMI of ₹80,000 to ₹1 Lakh to buy. While the monthly EMI is higher, it’s a fixed cost. Unlike rent, a home loan EMI stays the same, unaffected by market changes. Over time, as rent continues to rise, your EMI remains constant, eventually making homeownership not just a dream, but a financially sound and necessary strategy.