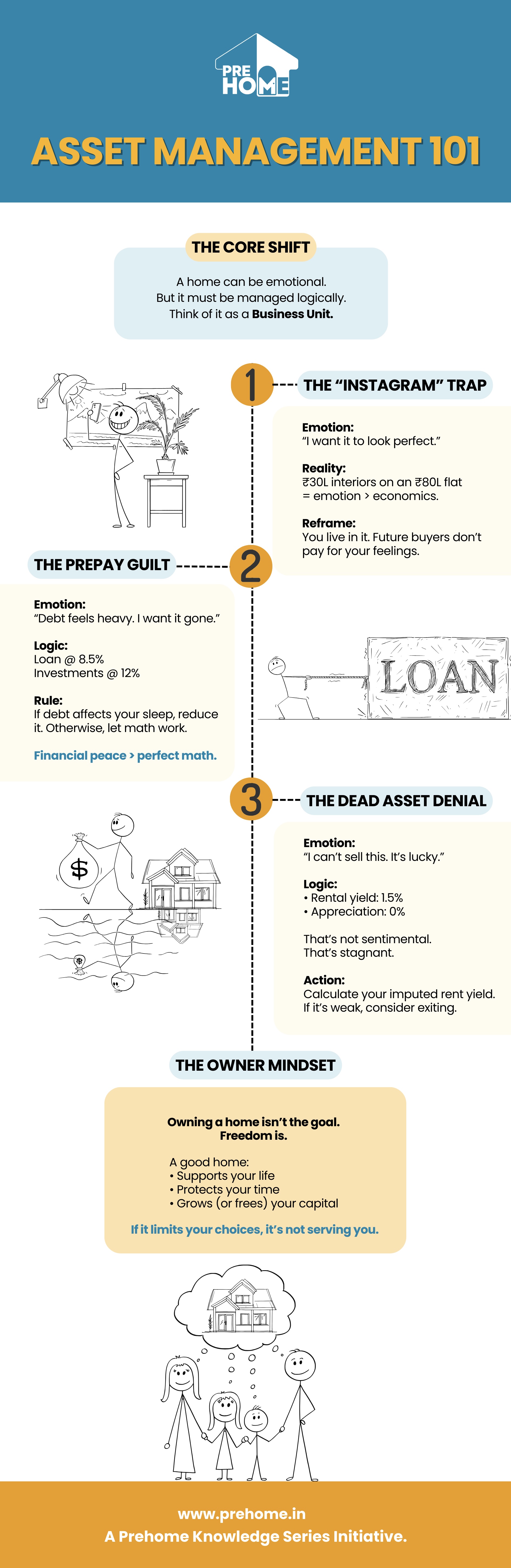

Asset Management 101: Moving From Emotional Attachment to Financial Logic

We are taught that a home is an "Emotion." But often, that emotion blinds us. We overspend on interiors to impress guests. We refuse to sell a bad asset because "it’s lucky." This emotional attachment is the enemy of wealth.

To achieve true financial freedom (F.I.R.E, Topic 9), you must learn to detach. Treat your home like a Business Unit.

1. The "Instagram" Trap (CapEx Overload)

-

- The Emotion: "I want my home to look like the magazine."

- The Reality : Spending ₹30 Lakhs on decor for an ₹80 Lakh flat is a major mismatch between feelings and sound financial decisions.

- The Mental Shift : Your home is for living, not showing off. Future buyers won’t pay for your feelings.

2. The "Prepay" Guilt

- You walk into your "Dream Home" and it echoes. It feels cold.

- The Emotion : "Debt feels heavy. I want to be free."

- The Logic : If your loan interest is 8.5% and your mutual funds earn 12%, keeping the loan is a smarter move.

- The Balance : Only prepay if worrying about debt disrupts your sleep. Peace of mind is more important than just numbers. Financial Peace > Financial Math

3. The "Dead Asset" Denial

-

- The Emotion : "I grew up here. I can't sell it."

- The Logic : If the rental yield is 1.5% and appreciation is 0%, your money is stagnating.

- The Action : Calculate your "Imputed Rent Yield." If the numbers aren’t good, be brave enough to sell. (Topic 12).

The Final Word: The "Owner" Mindset

The "Owner" Mindset The shift from "Tenant" to "Owner" isn’t just about paperwork; it’s a mental change. The goal isn’t just a paid-off house. The aim is to have a life where your house supports your freedom, not limits it.

Feeling overwhelmed by homeownership? Download this "Homeowner’s Mental & Financial Checklist" to organize your budget and clear your mind.