The Financial Impact: Under Construction vs. Ready-to-Move-In Properties

Introduction:

When deciding between under-construction and ready-to-move-in properties, it's crucial to consider the financial implications of your choice. This blog explores the payment structures, tax benefits, and potential savings associated with each option to help you make an informed decision.

Payment Schedules:

- Under-construction properties:

- Construction-linked payment plans

- Lower initial investment

- Potential for staggered payments over 2-4 years

- Ready-to-move-in properties:

- Lump-sum payment or shorter loan tenure

- Higher upfront costs

- Immediate full ownership

Tax Benefits

- Under-construction properties:

- Interest paid during construction phase deductible up to ₹2 lakhs per year (Section 24)

- Deductions can be claimed after possession

- Principal repayment benefits under Section 80C

- Ready-to-move-in properties:

- Immediate tax benefits on interest and principal repayments

- No accumulation of pre-EMI interest

- Potential for higher initial tax savings

Rental Savings Considerations

- Under-construction properties:

- Continued rental expenses during construction

- Potential for rental income loss if intended for investmen

- Ready-to-move-in properties:

- Immediate rental savings if for self-use

- Instant rental income potential if for investment

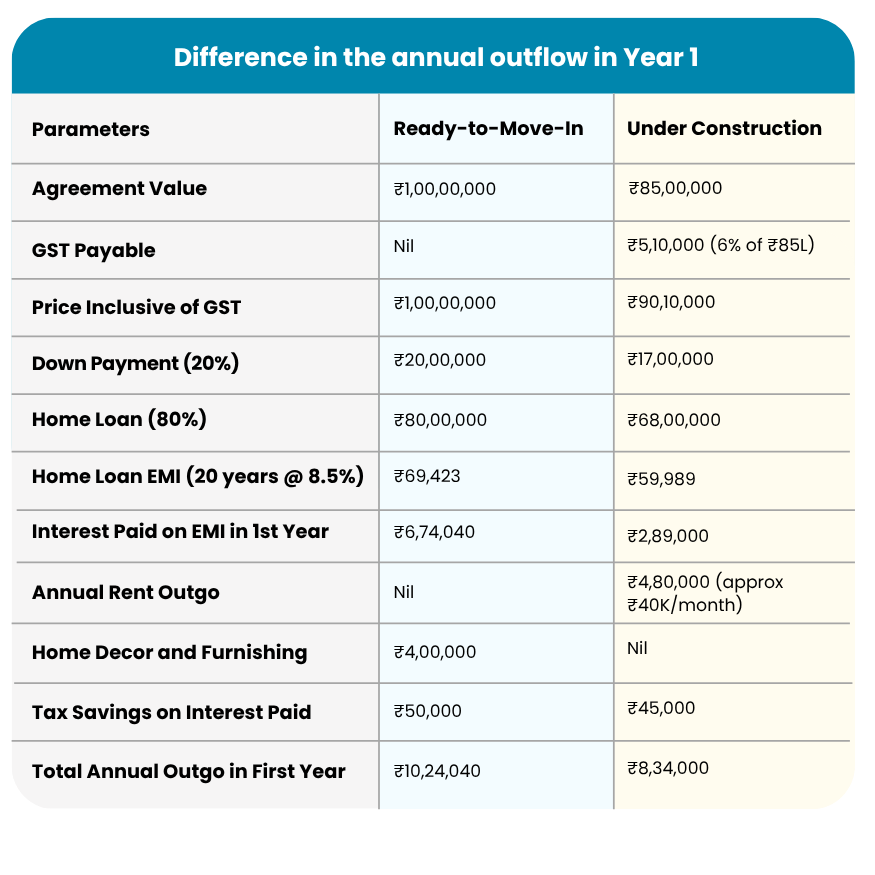

Let us understand with an example of buying a 2 BHK in Gurgaon. The locality, area, developer and flat types being the same. The only difference being that one is ready to move in vs the other which is under construction. The table below shows a clear difference in the annual outflow in year 1

Conclusion:

The financial implications of choosing between under-construction and ready-to-move-in properties extend beyond the initial price tag. Consider your current financial situation, tax planning needs, and long-term goals when making this decision. While under-construction properties may offer lower initial costs and potential for appreciation, ready-to-move-in options provide immediate benefits and certainty.

In our next blog, we'll explore strategies to mitigate risks in property purchases, ensuring you're well-equipped to make a safe and informed decision.