Investing in property, whether under-construction or ready-to-move-in, comes with inherent risks. This blog explores key strategies to protect your investment, highlighting the importance of regulatory compliance, thorough due diligence, and learning from others' experiences.

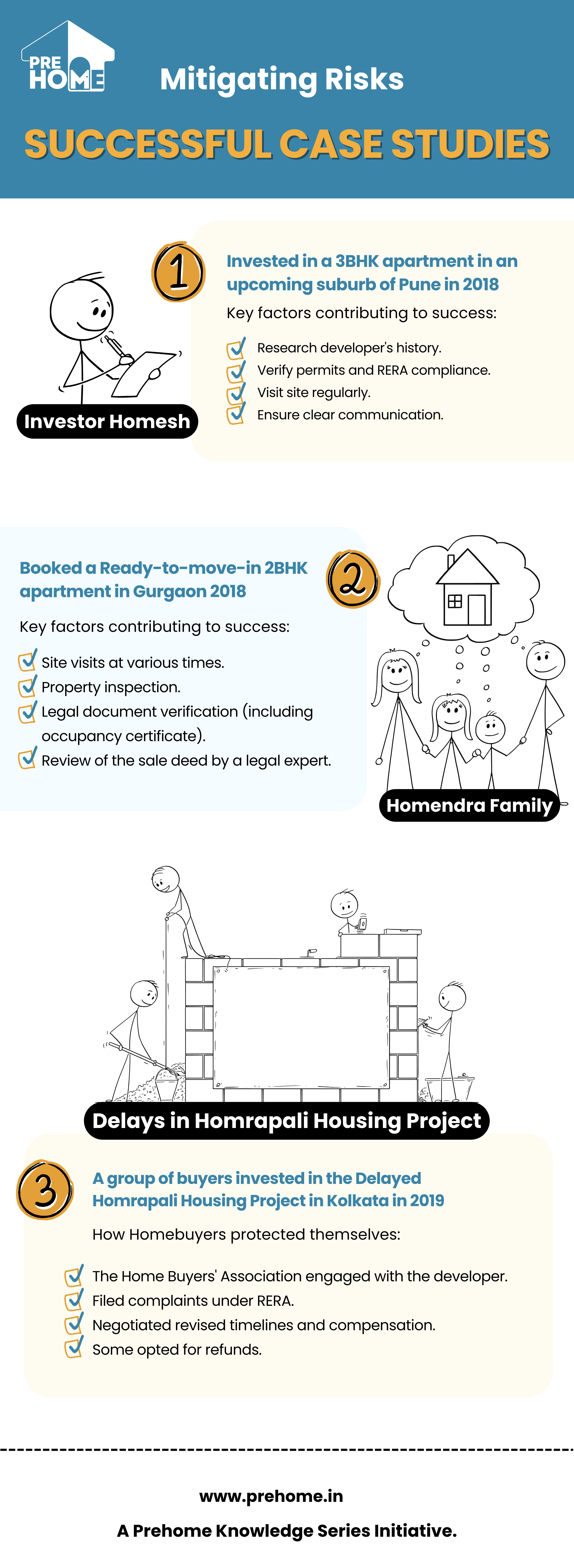

Homesh invested in a 3BHK apartment in an upcoming suburb of Pune in 2018. The project, by a reputable developer, was RERA-registered and promised completion in 36 months.

The project was completed on time, and Homesh moved in by 2021. The property value appreciated by 22% during the construction period, offering a significant return on investment.

Clear contracts, awareness of RERA provisions, and collective action can provide crucial protection in challenging scenarios.

The Homendra family, looking for immediate occupancy, chose a ready-to-move-in 2BHK in a well-established Gurgaon neighborhood in 2022.

The Homendra family moved in within a month of purchase, enjoying a smooth transition with no unexpected issues or costs.

For those prioritizing certainty and immediate occupancy, ready-to-move-in properties can offer a hassle-free experience when proper checks are conducted.

A group of buyers invested in the Homrapali Housing Project in Kolkata in 2019, facing significant delays due to regulatory issues and financial constraints of the developer.

While the project was eventually completed in 2023 (18 months behind schedule), buyers who stayed received compensation for the delay. Those who exited received refunds with interest.

Clear contracts, awareness of RERA provisions, and collective action can provide crucial protection in challenging scenarios.

Mitigating risks in property purchase requires a combination of regulatory awareness, thorough due diligence, and learning from others' experiences. Whether you choose an under-construction or ready-to-move-in property, being informed and vigilant can significantly reduce your risk exposure and lead to a satisfying investment.

As we conclude this series on choosing between under-construction and ready-to-move-in properties, it's clear that both options have their merits and challenges. For those seeking a middle ground that combines the benefits of both, consider exploring rent-to-own options. This innovative approach allows you to move in immediately while building equity over time, potentially offering a balanced solution to your housing needs.

In our next topic, we'll delve into "Decoding the True Value of Property," helping you understand the factors that contribute to a property's worth beyond its price tag.