Making an Informed Housing Decision: Balancing Rental Inflation and Home Price Appreciation

Introduction:

In our journey so far, we've explained the two main financial pressures in your life: rising rental costs and fluctuating home prices. We've found that the traditional choice between renting and buying often leads to two unsatisfactory options. Now, let's look at a modern housing model that seeks to address this issue: Rent-to-Own (RTO).

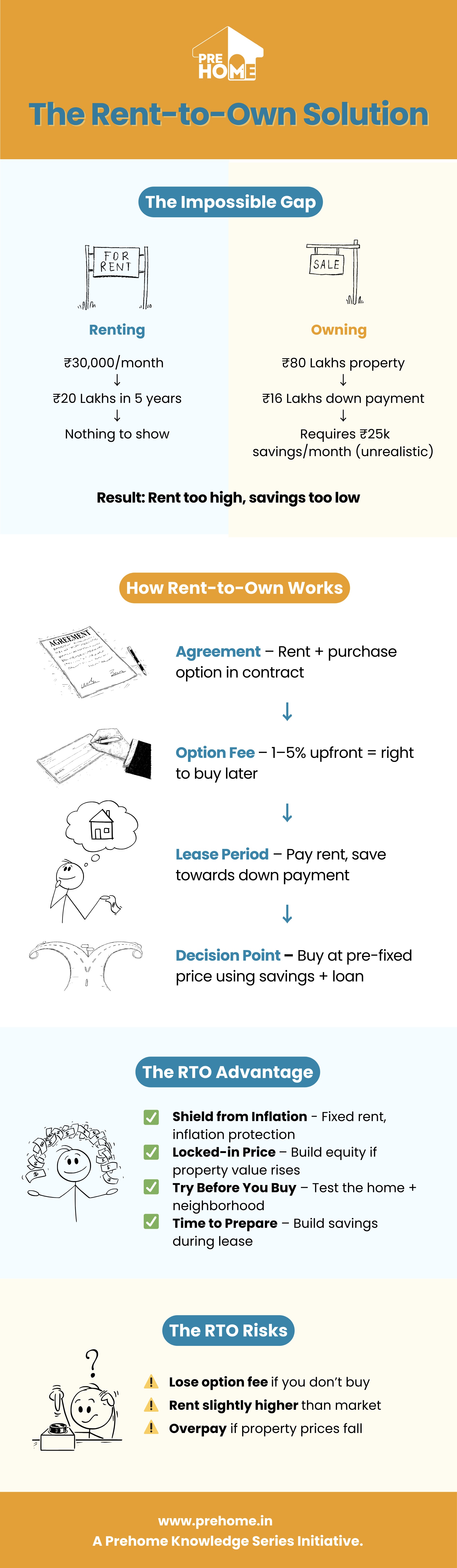

The Impossible Gap: The Rent-vs-Buy Reality

The dilemma isn’t just a feeling; it’s a financial fact. When you look at the numbers, the usual paths often result in a dead end for the average urban professional.

- Let’s consider someone earning a middle-range salary in a city like Bengaluru.

- The Renting Cost: The average rent for a 2BHK is around ₹30,000 per month. With a 10% yearly increase in rent, you'll spend nearly ₹20 Lakhs on rent over five years, with nothing to show for it.

- The Buying Barrier:To purchase a similar 2BHK apartment in the same city, you’ll need to consider a property price of at least ₹80 Lakhs. As a first-time homebuyer, you must have a down payment of at least 20%, which comes to ₹16 Lakhs.

- The Savings Struggle: Now, think about the reality. To save that ₹16 Lakhs for the down payment, a person would need to put away at least ₹25,000 each month for over five years without interruptions. With average rent at ₹30,000 and increasing living expenses, this level of saving is often impractical.

This explains the core problem: you are financially stuck. Your rent is too high to let you save for the down payment you need to stop renting.

How Rent-to-Own Works in India: A Step-by-Step Guide

The Rent-to-Own model, though not yet common in India, is a hybrid agreement gaining popularity as a flexible way to buy a home. It involves a clear legal process.

-

- The Agreement: You sign a legal contract with the developer or seller. This contract includes two main parts: a standard rental agreement and a purchase option clause. It states the lease term (usually 1-3 years), the monthly rent, and the set purchase price for the home.

- The Option Fee: You pay a non-refundable "option fee" upfront (generally 1-5% of the property value). This fee is separate from the rent and gives you the exclusive right to buy the home at the end of the term.

- The Lease Period: You live in the home and pay a premium rent as a tenant. Completing the rent obligations on time allows for you to build for your down payment during the decision point.This setup helps turn your rent into a kind of forced savings.

- The Decision Point:At the end of the lease term, you can choose to buy the property at the agreed-upon price. Now that you are down payment ready, you can then secure a home loan for the remaining amount

The Honest Pros and Cons: Is It a Smart Choice?

To make an informed decision, you need to weigh both the key benefits and the possible downsides of the RTO model.

-

The Pros (The RTO Advantage)

- Shield Against Inflation:Your monthly payments are fixed, providing protection against the rental inflation we discussed earlier.Your rent is not just an expense; it’s an investment in your future.

- The Locked-in Price:The biggest benefit is protection from future price increases. If your home’s value goes up by 20% during your lease, you can still buy it at the original, lower price. This gives you immediate equity.

- Try Before You Buy:RTO lets you "test drive" the home and neighborhood before making a long-term financial commitment. You can look for structural issues, evaluate the commute, and ensure it suits your family's needs.

- Time to Build Finances::If your credit score is low or you haven’t saved enough for a full down payment, the RTO period allows you time to improve your financial situation and qualify for a home loan.

-

The Cons (The RTO Risks)

- Loss of Upfront Fee:If you choose not to buy the home or can't secure a home loan at the end of the term, you lose the non-refundable option fee

- Potentially Higher Rent:The monthly rent in an RTO agreement is often slightly higher than the market rate.

- Market Risk:While RTO protects you from rising prices, you might end up overpaying if home values drop below the agreed price.

- Maintenance Liability: Some RTO agreements place the responsibility for maintenance and repairs on the tenant, leading to unexpected costs.

The Final Takeaway: Making Your Decision

Rent-to-Own is not a perfect solution, but it offers a strong and balanced answer to today's housing challenges. It provides a meaningful pathway for those caught between wanting to own a home and facing market uncertainties.

Ultimately, the best choice is the one that suits your individual circumstances. By understanding the full picture of rental inflation, home price changes, and the Rent-to-Own model, you can be a more informed and empowered decision-maker.