In our last blog, we explored the many challenges NRIs face when selling property in India, including distance, transparency problems, taxes, and issues with moving money back. These obstacles often lead NRIs to make hasty sales, which means they miss out on potential profits.

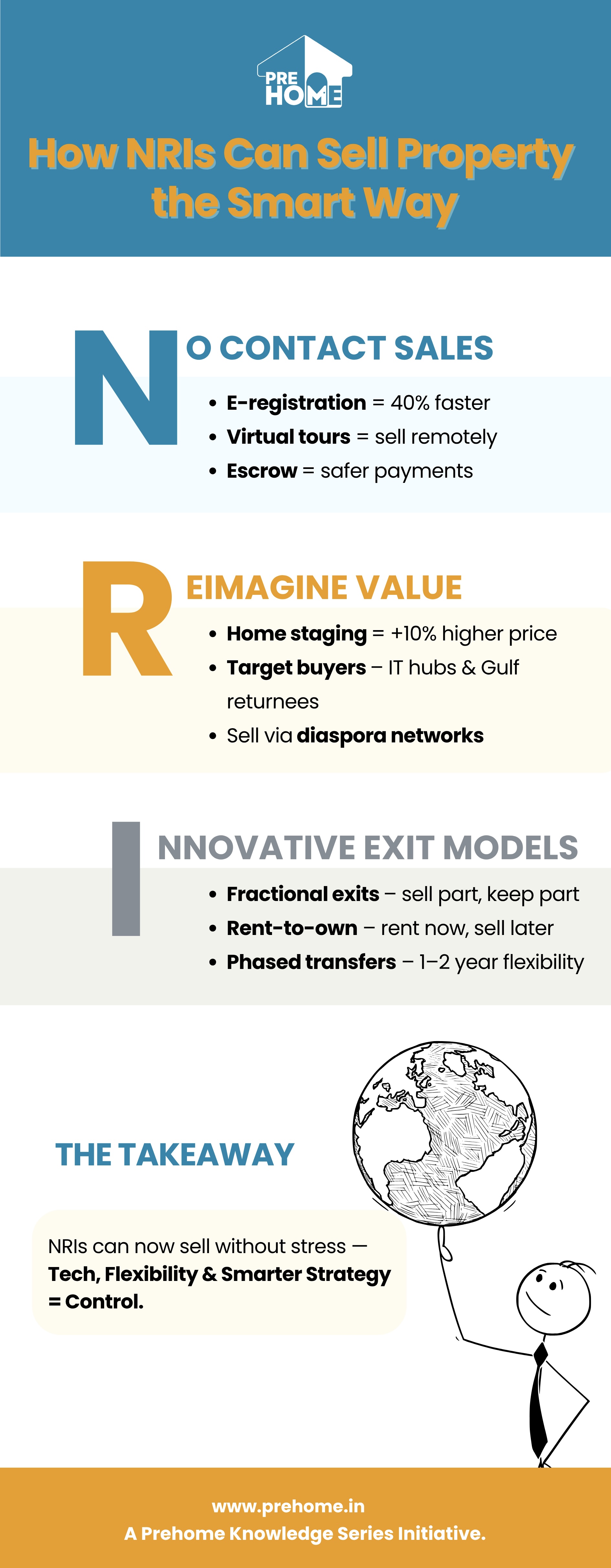

But selling property doesn’t have to feel like a struggle from afar. With new digital tools, clear models, and flexible exit strategies, NRIs now have more options than ever to sell smartly and on their terms.

Let’s examine some innovative approaches that are changing how NRIs divest their properties.

The days of endless paperwork and needing to be physically present to sell property are over.

This is a significant improvement from the “trust gap” we discussed in Blog 1. Digital-first sales help balance the information gap that NRIs often face.

Sometimes, the best way to exit isn’t an immediate sale; it’s about having structured options.

Aha Stat: Almost 38% of NRI-owned homes in India remain locked or underused (ANAROCK 2023). Flexible exit models help put these unused assets to work.

Even with the distance, NRIs can achieve better value by positioning their properties wisely.

This ties back to Topic 7 (Rental Inflation vs. Appreciation): just as timing the market is crucial for buyers, positioning the property effectively is vital for sellers, especially for NRIs.

Selling property as an NRI doesn’t have to involve long waits, distress pricing, or confusing paperwork. By using digital-first processes, flexible models, and strategies to maximize value, NRIs can take charge of their sales.

In our next blog, we’ll look into the legal and financial aspects behind these strategies, covering compliance, tax optimization, and how to protect your interests during complex property transactions.

And if you haven’t read Blog 1 of this series, check it out—it outlines the main challenges these solutions aim to address.