In our last blog, we discussed why homeownership is the true starting point for financial independence. Beyond stability and emotional security, there’s something even more powerful—equity, the quiet force that turns every EMI into long-term wealth. Understanding how equity grows and learning how to speed it up can significantly shorten the journey to financial independence, which is at the heart of the F.I.R.E movement.

Equity is the portion of your home that you truly own—your property’s current market value minus the unpaid loan amount. If your apartment is worth ₹80 lakh and your loan balance is ₹50 lakh, you own ₹30 lakh outright. Each EMI quietly increases that number.

Equity transforms a liability (a loan) into an asset that compounds in your favor, perfectly aligning with F.I.R.E’s first principle: build assets that earn even while you rest.

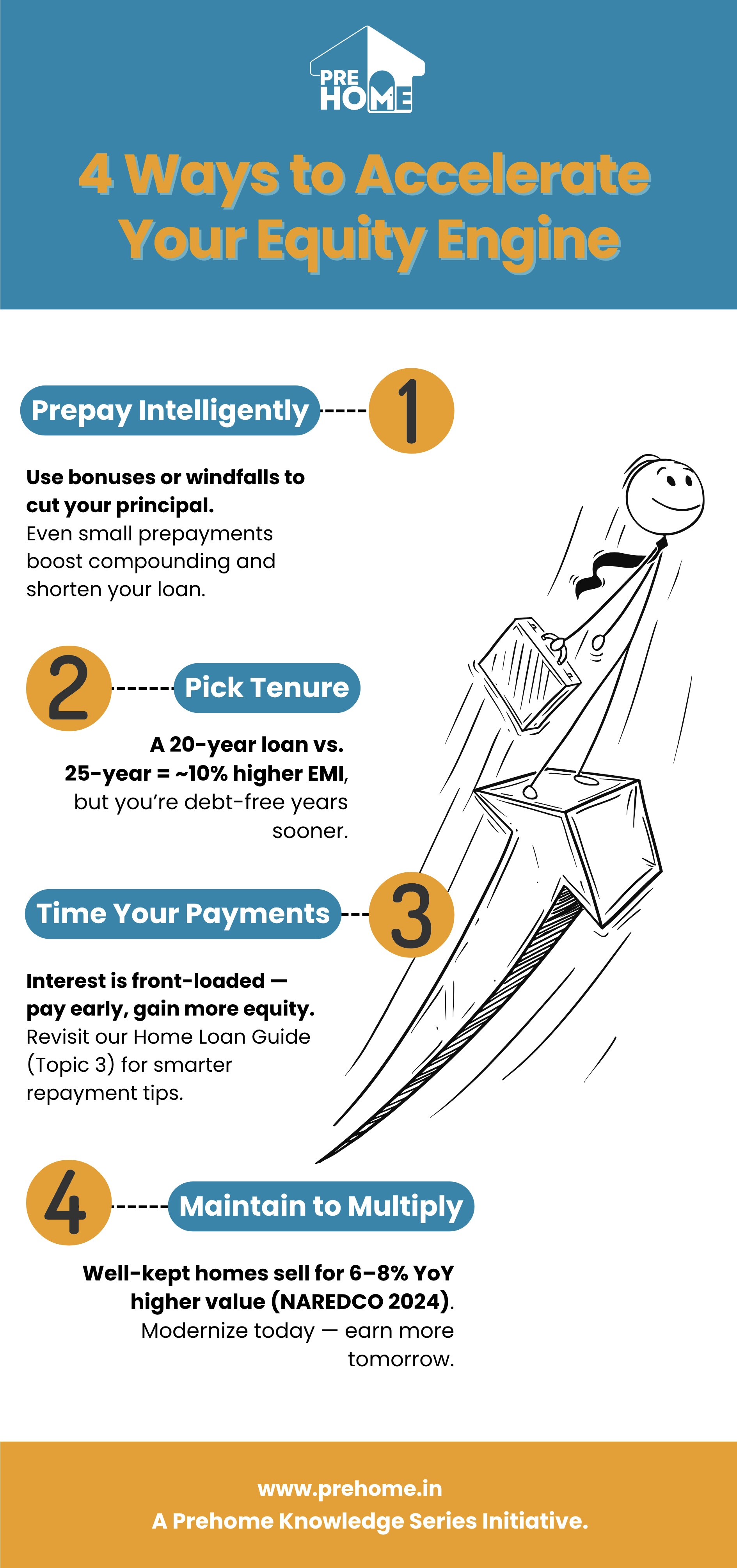

Although home loans in India usually last 20 years, data from RBI and HDFC (2024) shows that the average borrower fully repays in just 6 to 8 years. This quicker repayment—driven by bonuses, job changes, and a cultural aversion to long-term debt—means most homeowners begin building pure equity much earlier than their loan term suggests.

By the 7th year, nearly 40–45 % of the property value is owned outright, and appreciation compounds on that base. For someone focused on F.I.R.E, this is crucial: your equity starts generating “silent income” years before you retire.

Two factors make equity powerful:

Together, they create what financial planners call dual compounding—growth from both ends.

A homeowner who prepays just one extra EMI each year can shorten their loan by 3–4 years and save ₹9–10 lakh in interest (HDFC 2024).

That’s F.I.R.E’s principle of minimizing expenses in action: pay interest to yourself, not to the bank.

Once built, equity can support the next phase of the F.I.R.E journey—financial independence through smart leverage.

When used wisely, equity becomes the bridge from active income to passive income—that’s F.I.R.E’s key goal.

Between 2013 and 2023, India’s average CPI inflation was about 5.5 %, while urban housing prices increased by 6–9 % (Knight Frank 2024).

Each fixed EMI effectively buys future rupees at today’s price. Over time, your real debt burden reduces, but your asset value keeps up with or exceeds inflation—an excellent example of real-asset arbitrage that supports early retirement goals.

Equity is the hidden engine that drives F.I.R.E from beneath the roof you live under. Each EMI turns uncertainty into ownership, and ownership into choice—the ability to decide when and how to work.

From the behavioral stability we discussed in Blog 25 to the financial mechanics here, homeownership shows that freedom comes from steady accumulation, not volatility.

In our next blog, we’ll explore how to turn that accumulated equity into sustainable passive income through rentals, co-living models, and tax-efficient cash flows that keep the F.I.R.E flame alive long after the EMIs end.