The Home Price Myth: Demystifying Appreciation

Introduction:

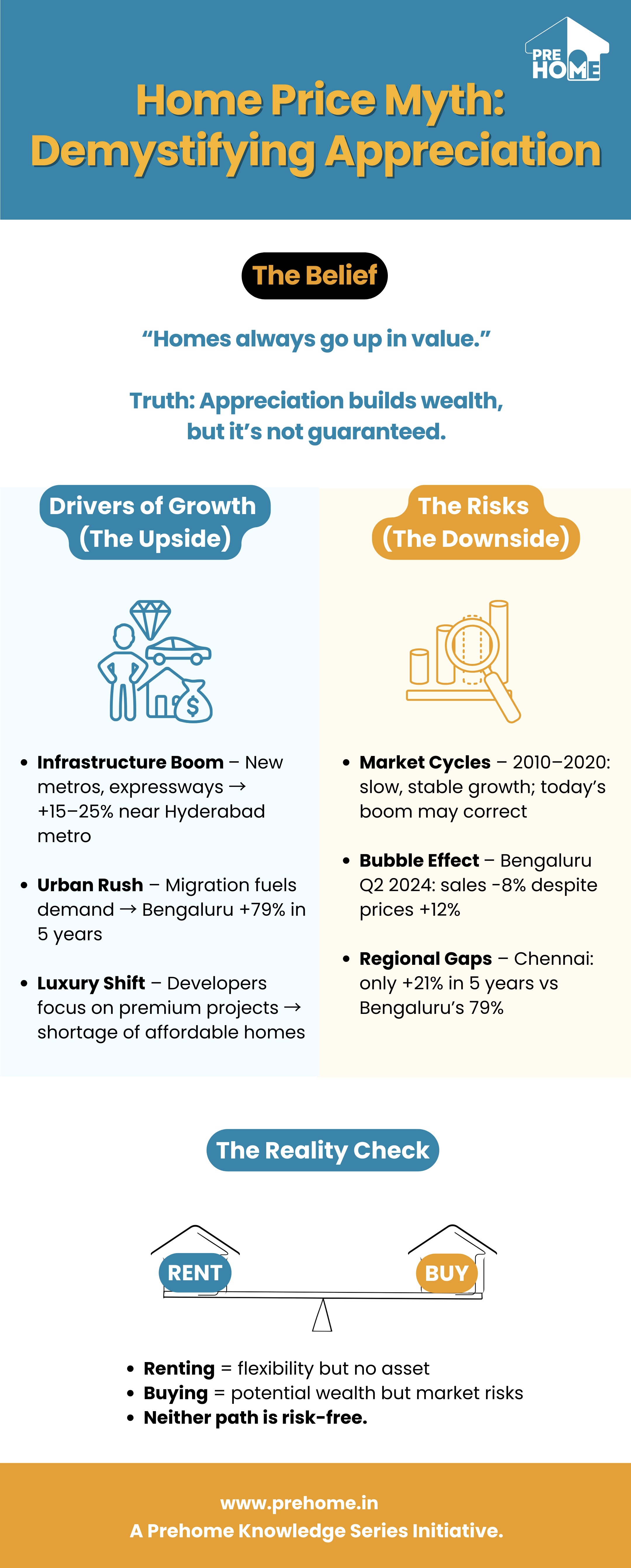

In our last blog, we talked about how rental inflation can strain your budget. Now, let's consider the other side: home price appreciation. For many, this is the main reason to buy a home; they believe its value will only go up. But is it really that simple? This blog will explain property appreciation and help find a balance between renting and buying.

The Power of Appreciation

Home price appreciation is the increase in a property's value over time. It is the key way to build wealth through homeownership. In India, several factors drive this growth:

-

- Infrastructure Growth: The government's focus on infrastructure, such as new metro lines, flyovers, and expressways, is directly boosting price increases. For example, property values in areas near new metro lines in Hyderabad have risen by 15-25% over the past few years.

- The Urban Rush:The ongoing migration to cities like Bengaluru, Mumbai, and Delhi-NCR keeps demand for housing high. In just the last five years, Bengaluru has experienced a remarkable 79% jump in real estate prices, making it a clear leader.

- The Luxury Shift: Developers are focusing more on high-margin luxury projects. This shortage of affordable homes raises prices across all segments, as buyers compete for limited options.

The Risk Behind the Reward

Appreciation Isn't Guaranteed While the numbers may seem encouraging, expecting constant appreciation is misleading. The market does not always move in one direction; there are times of stagnation and correction.

-

- Market Cycles: The Indian real estate market goes through cycles. From 2010 to 2020, it mostly experienced stability and moderate growth rather than the sharp increases we see today. The recent boom is largely a rebound from the pandemic, and prices are likely to return to a more sustainable growth rate.

- The Bubble Effect: Quick, unsustainable price increases can create affordability problems, leading to a drop in sales. For example, in the second quarter of 2024, Bengaluru's housing sales fell by 8% despite a 12% price rise, suggesting that the market might be reaching a peak in affordability.

- Regional Differences: Appreciation varies by location. While prices in Bengaluru have skyrocketed, other cities like Chennai only saw a modest 21% increase during the same five-year period. The success of your investment depends heavily on its location and the local economy.

The Final Word: The Rent-to-Own Solution

We have now looked at both sides: the unpredictability of rental inflation and the uncertainty of home price appreciation.

Renting provides short-term flexibility but leaves you at risk of continuous rent increases with no long-term asset to show for it. Buying offers the possibility of an appreciating asset, but it comes with the risk of high prices in a fluctuating market.

This raises an important question: How can you find a solution that combines the stability of a fixed cost (like an EMI) with the potential for appreciation without facing the risks of market fluctuations? This is the dilemma we will address in our final blog.