The Legal & Financial Playbook – Selling Smart and Safe as an NRI

Introduction:

In our last blog, we looked at smarter exit strategies, including digital-first sales, flexible models like rent-to-own, and techniques to maximize value. However, even the best strategies fail without strong legal and financial planning.

For NRIs, this is where deals often fall apart: paperwork can be missed, taxes may be miscalculated, or compliance might be ignored. In this final blog of the series, let’s break down the legal and financial playbook that helps you sell smart and safe.

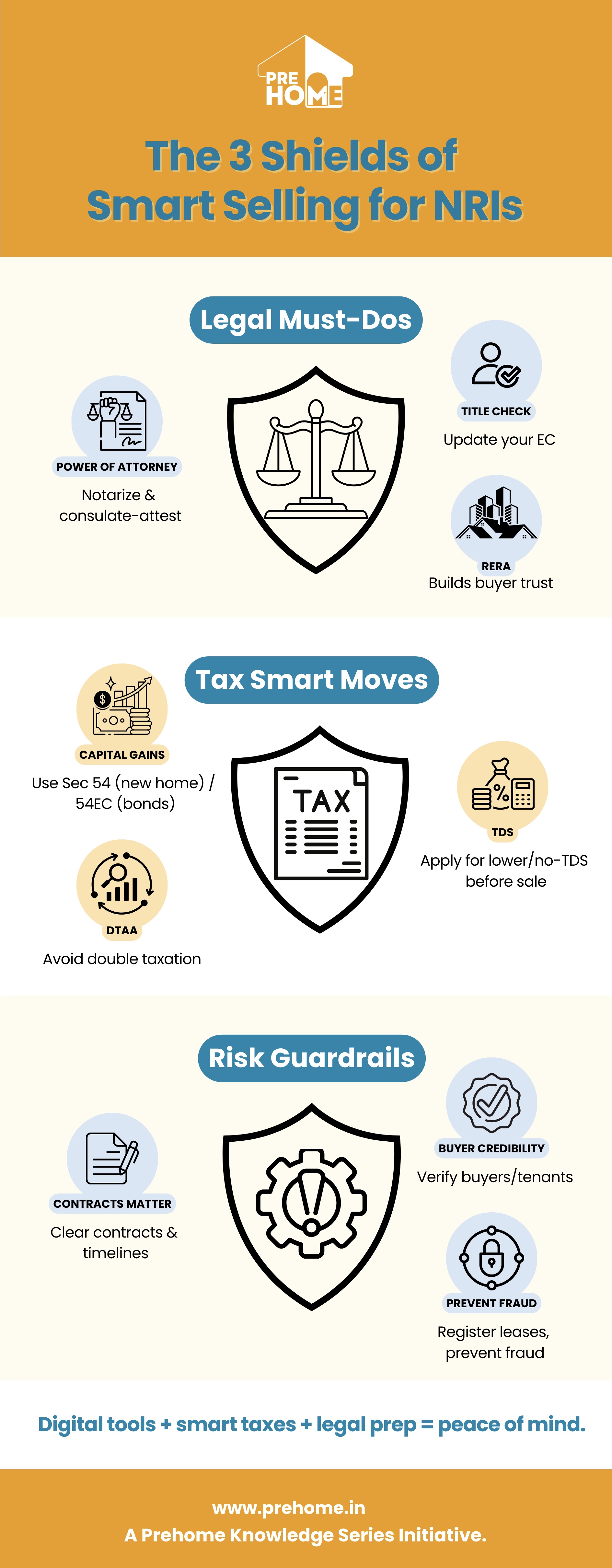

1. Legal Safety Nets for NRI Sellers

The legal framework for property sales is intended to protect sellers, but only if you know how to use it.

-

- Power of Attorney (POA): A common option for NRIs. It must be notarized in the country of residence and attested by the Indian consulate. An improper POA execution is one of the main reasons for disputes during a sale.

- Title & encumbrance checks: Before listing, sellers should get an updated Encumbrance Certificate (EC). According to NCR case data from 2023, one in six NRI property disputes arises from unclear titles or existing encumbrances.

- RERA protection: For properties under construction, RERA registration builds buyer confidence, which helps reduce negotiation delays.

This ties back to Blog 1, where we discussed how NRIs’ limited physical presence creates trust gaps. Strong legal preparation helps close that gap.

2. Tax Optimization Strategies

Taxes often take a big chunk of NRI sale proceeds. Smart planning can save significant amounts.

-

- TDS Refund Planning: Buyers usually deduct 20 to 30% TDS upfront. If your actual tax liability is lower due to exemptions, you can apply for a lower or no TDS certificate from the Income Tax Department before the sale. This way, you can avoid delays in receiving refunds.

- Capital Gains Exemptions:

- Section 54: Reinvesting in another residential property can help you avoid long-term capital gains tax.

- Section 54EC: Investing in REC or NHAI bonds (up to ₹50 lakh) within six months of the sale secures an exemption.

- DTAA Leverage: Countries like the US, UK, and Singapore have DTAA agreements with India. However, a 2022 Deloitte survey revealed that over 40% of NRIs don’t know how DTAA credits can help reduce double taxation.

If you recall Topic 6, we showed how small overlooked costs can add up. For NRIs, ignoring tax planning can lead to significant losses.

3. Risk Mitigation in Innovative Models

Innovative sale strategies, like fractional exits, phased transfers, or rent-to-own, are promising but need careful planning.

-

- Contracts matter: Phased transfers require clear agreements that define timelines, payment schedules, and default clauses.

- Due diligence on buyers: For rent-to-own arrangements, choosing tenants with solid financial backgrounds is key. Platforms that pre-qualify buyers or tenants can lower risks.

- Fraud prevention: NRIs are often targets of property fraud. In fact, a 2023 survey by LocalCircles found that 35% of NRIs who owned property in India worried about encroachment or unauthorized occupancy. Legal protections, such as registered lease deeds and regular checks, are important.

The Final Word

The NRI property sale journey is like a three-act play:

-

- Blog 1 outlined the challenges: distance, trust issues, taxes, and currency barriers.

- Blog 2 presented innovative solutions: digital platforms, flexible exits, and strategies for maximizing value.

- Blog 3 provides the playbook: the legal and financial guidelines necessary for a safe, compliant, and profitable transaction.

For NRIs, selling smart isn’t only about getting a good price; it’s also about maintaining peace of mind across continents. With the right combination of digital tools, tax planning, and legal protections, this is now more attainable than ever.

But there’s a bigger question at play: What role does real estate have in building long-term financial independence? For many NRIs, and even resident Indians, property isn't just something to sell; it is a crucial part of wealth-building and retirement planning.

In our next topic, we will explore why homeownership is often central to the F.I.R.E. movement (Financial Independence, Retire Early) and how owning the right home at the right time can speed up your path to true financial freedom.