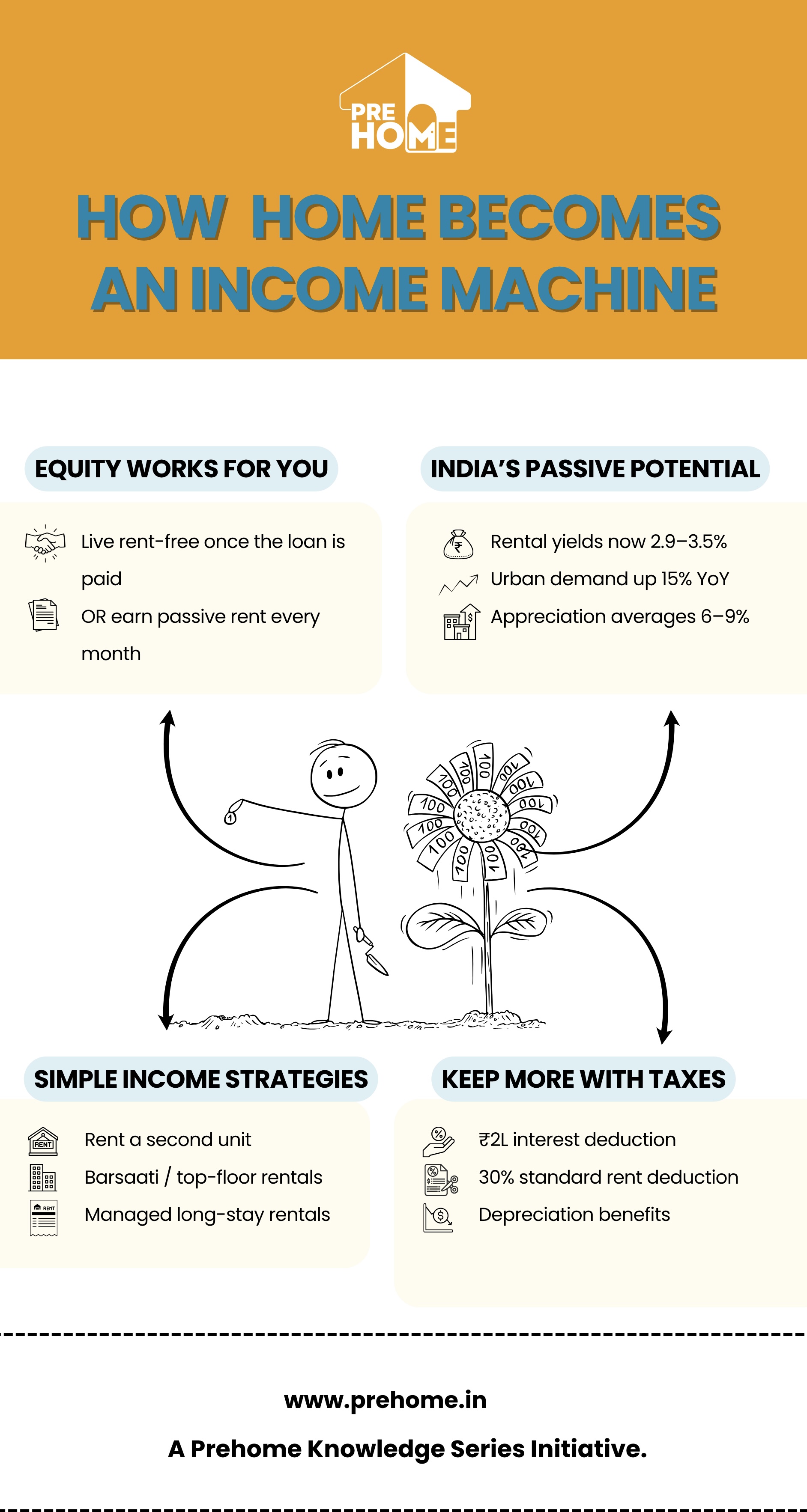

The Passive Power – Turning Homes into Income Streams

Introduction:

In our previous blogs, we discussed how owning a home supports financial independence and how equity builds up with each payment. Now, we focus on the final step: turning that built-up equity into income that works for you even when you’re not.

At its heart, the Financial Independence, Retire Early (F.I.R.E) movement is about swapping earned income for income from assets. For many Indian households, this change starts with their most tangible asset: real estate.

1. When Equity Starts Earning

Once your home loan is mostly or fully paid off, your equity becomes a valuable financial resource. At this point, you can choose between two paths to build wealth:

-

- Rent-free living: Reducing your monthly living expenses to nearly zero, which is like earning income for those pursuing lean F.I.R.E.

- Passive rental income: Renting out your property or parts of it to create cash flow that supplements or replaces your salary.

This change represents the F.I.R.E principle of moving from active income to income from assets, marking true independence.

2. Understanding India’s Passive Property Potential

Real estate has long been a favorite income source in India. Recent data shows it’s becoming even more important for long-term wealth planning.

-

- Rental yields: The average gross residential rental yields in Indian cities are now between 2.9% and 3.5%, up from 2% a few years ago (Knight Frank, 2024).

- Urban demand: In cities like Bengaluru and Hyderabad, rental demand increased over 15% year over year in 2024 due to returning workforces and migration.

- Appreciation synergy: Even modest yields, combined with 6% to 9% appreciation over time, create annual returns that compete with balanced portfolios.

In simple terms, owning a property that generates rent can act like a “dividend” version of real estate, growing while you focus on other things.

3. Practical Income Strategies for Indian Homeowners

-

- Traditional Rentals Renting out a second property or a full self-contained unit remains the most reliable source of passive income. Even modest yields of 2.9% to 3.5% annually (Knight Frank, 2024) can help offset living costs and support semi-retirement goals.

- The Indian Parallel to “House Hacking” – The Barsaati or Independent Unit In many Indian homes, especially duplexes or independent houses, owners often rent out the top floor, barsaati, or a separate outhouse with an independent entrance. This method brings rental income without the risks of subletting, as the rental unit is separate from the main dwelling.

It’s popular among young professionals, students, and small families looking for affordable housing city living—a segment that grew over 18% year over year in major metros (ANAROCK, 2024).

For homeowners aiming for financial independence, this model provides a steady income while keeping full control over their main residence.

- Short-Term or Long-Stay Rentals Platforms offering verified long-stay or managed rental services simplify leasing such units safely and transparently. With proper agreements and reliable tenants, these models can yield higher returns and consistent occupancy while staying within compliance.

4. Tax Efficiency – Keeping More of What You Earn

Owning income-producing property also provides several tax benefits that align with the F.I.R.E principle of efficiency:

-

- Interest deduction: Under Section 24(b), homeowners can claim up to ₹2 lakh per year as an interest deduction on home loan EMIs if the property is rented.

- Depreciation benefits: For secondary properties, depreciation deductions lower taxable income from rent, effectively increasing post-tax yield.

- Maintenance and municipal tax deductions: Homeowners can claim 30% of annual rent as a standard deduction, no matter the actual expense.

When structured correctly, these benefits can raise net rental yields from 3% to nearly 4% or 4.5% post-tax, which is significant for those seeking early retirement.

5. Beyond Rent: Strategic Use of Equity for Passive Growth

Your home’s equity can also support passive income in indirect ways:

-

- Loan against property (LAP): Use equity for investments in REITs, mutual funds, or small businesses.

- Fractional real estate platforms: Participate in Grade-A commercial properties offering 7% to 9% annual returns, while keeping liquidity.

- Rent-to-own models: A forward-thinking structure that allows tenants to become buyers over time, providing predictable cash flow.

Each of these options fits the F.I.R.E framework: turning static assets into income-generating systems without unnecessary risk.

6. The Compounding of Freedom

When viewed through the F.I.R.E lens, passive property income isn’t merely about returns—it’s about getting your time back.

The rent from one well-placed property can cover your regular monthly expenses. Add another, and it could fund travel, hobbies, or a flexible semi-retirement. This is why many early retirees in India see real estate as the “sleep well” layer of their financial plan—it’s predictable, inflation-protected, and backed by assets.

The Final Word

Over the last three blogs, we explored the complete F.I.R.E cycle of homeownership:

-

As we conclude this F.I.R.E-focused trilogy, one insight stands out: ownership unlocks flexibility. Whether you leverage equity, rent part of your property, or use your home to generate income, ownership allows you to make money work for you.

In our next topic, we’ll look at a new approach emerging in India that connects renting and owning—the Rent-to-Own model. We’ll break down how it works, step by step, and how it lets aspiring homeowners enjoy the benefits of ownership even before making a purchase.