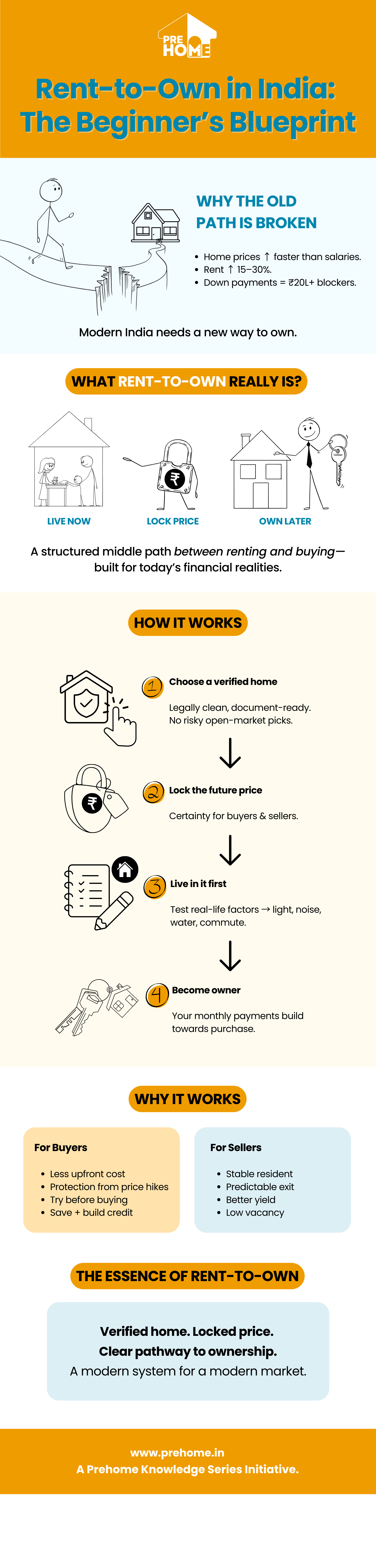

Rent-to-Own in India: The Beginner’s Blueprint

For decades, the journey to homeownership in India followed a predictable path:

Rent → Save → Buy → Pay EMIs → Own.

However, as home prices rise faster than incomes, down payments become heavier, and urban mobility changes preferences, this linear path is getting harder to follow.

- In previous topics, we explored this shifting reality:

- Topic 2: Down payments strain financial freedom.

- Topic 3: Home loans front-load interest during the first 7–8 years.

- Topic 6: Hidden costs make both renting and owning more expensive than they appear.

- Topic 7: Rental inflation quietly affects savings.

This leads to an uncomfortable truth: the traditional pathways to homeownership no longer suit modern lifestyles.

Topic 10 introduces a model designed for this era — a structured, transparent, and India-ready version of Rent-to-Own (RTO).

1. Why India Needs New Pathways to Ownership

- India’s housing market is changing faster than household financial comfort:

- Home prices in most major cities have risen 10–18% year over year (Knight Frank 2022–24).

- Salaries have risen by 8–9% year over year (Aon Salary Report 2024).

- Rental inflation in cities like Bengaluru, Pune, Hyderabad, and Gurgaon has exceeded 15 to 30% year over year in certain micro-markets (ANAROCK 2024).

- A 20% down payment on a ₹1 crore home requires ₹20 lakh upfront —which is a barrier for many first-time buyers.

2. What Exactly Is Rent-to-Own? (Global Idea, India-Specific Need)

- Rent-to-Own is a hybrid path where you:

- Rent and live in the home today,

- Lock in a fair price for the future, and

- and transition into ownership within a set timeframe.

- Globally, RTO is popular in the US, Canada, UK, Australia, and parts of Europe among:

- Young professionals

- Credit-building families

- Gig workers (the new working class)

- People who want to avoid buyer’s remorse

- In India, the demand is emerging because RTO addresses three major challenges:

- High down payment requirements

- Difficulty in verifying homes and builders

- Fear of making a long-term EMI commitment too early

RTO is not a replacement for home loans — it is a structured entry point that helps residents become confident, ready homeowners.

3. How Rent-to-Own Works — Built for India’s Real Market Realities

India’s real estate market is unique. Issues like unclear titles, legal encumbrances, unverified sellers, mismatches with sample flats, informal agreements, and different documentation requirements across states mean that unstructured RTO can be risky.

A responsible, India-ready RTO path therefore follows a clear structure:

Step 1: Choose Your Home from a Verified List

Unlike Western markets, in India you cannot safely choose any home for RTO.

- This is because:

- Title clarity varies widely

- Builder approvals differ

- Many properties have pending litigation

- Society permissions may restrict rentals

- Buyers often cannot independently verify documents

- Sellers worry about long-term issues with informal structures

A verified, diligence-ready property list protects both sides.

- It ensures that every home is:

- Legally verified

- Financially clear

- Documentation-ready

- Suitable for structured rent-to-own

This makes Step 1 not just important, but essential: Choose from a verified, pre-screened list — not from the open market.

Step 2: Lock the Future Price

Both parties agree on a transparent, market-aligned future purchase price.

- This avoids disputes and protects:

- Buyers → from unpredictable price appreciation

- Sellers →from prolonged uncertainty

In cities where home prices rise 6–10% annually, this creates stability for everyone.

Step 3: Move In and Experience the Home Fully

- You live in the property as a resident and evaluate it in real life:

- Traffic

- Light & ventilation

- Noise

- Water pressure

- Society culture

- Commute

- Daily convenience

This solves the biggest pain point in Indian real estate: The difference between what you see and what you actually experience.

Step 4: Build Toward Ownership Through Monthly Payments

- Your monthly payments are structured to:

- Cover living

- Contribute toward your future purchase

- Build savings habits

Unlike renting, your money serves a future purpose.

Step 5: Convert to Ownership Within the Agreed Window

- When ready, you complete the purchase using the:

- Locked price

- Built-up contributions

- Verified documentation

- Confidence from living in the home

Buyers gain time and stability.

Sellers gain predictability and clarity.

It’s a balanced approach where both sides benefit, not compete.

4. Why Rent-to-Own Works for Buyers

- When ready, you complete the purchase using the:

- Lower upfront cost

- Price protection in inflationary markets

- Test the home before committing

- Time to save and improve creditworthiness

- No fear of “wrong decision” regret

- Smoother transition into home loans when ready

- This is especially powerful for:

- Young families preparing for down payments

- Professionals new to a city

- Households wanting flexibility without losing momentum

- Tenants tired of paying rising rents with no long-term outcome

5. Why Rent-to-Own Works for Sellers

- When ready, you complete the purchase using the:

- Stable, long-term resident

- Predictable future exit

- Better yield than standard rent

- Lower vacancy risk

- Clear expectations from day one

- Less friction in negotiations at the time of sale

For homeowners or investors who value certainty, this is a strong alternative to pure renting or waiting for the “perfect” buyer.`

6. Key Concepts to Know (Explained Simply)

- Rent-to-Own revolves around three core principles:

- A verified home you can trust

- A future price that you lock today

- A clear pathway from tenancy to ownership

The legal structure behind this differs by model — and is crucial for safety. Which brings us to the next part of the series.

In Our Next Series

Rent-to-Own is effective, but only when the documentation, structure, and compliance are professionally designed.

India’s property market rewards clarity — and punishes informality.

- In Blog 29, we will discuss:

- What makes an RTO agreement safe

- What protections both sides need

- What outcomes a good structure must guarantee

- And the common mistakes people must avoid