The True Cost of Homeownership: Beyond the Purchase Price

Introduction:

In our earlier posts about choosing between renting and buying, we highlighted that becoming a homeowner is a big financial commitment. Buying a home marks an important milestone. Many first-time homebuyers in India are surprised by one-time and recurring costs that can significantly increase their overall budget. These costs aren’t just minor fees; they can turn a planned purchase into a financial burden.

In this guide, we will explore the full range of homeownership costs. We’ll cover everything from mandatory government fees to additional charges from developers. Our goal is to give you a clear financial picture so you can approach your purchase with confidence.

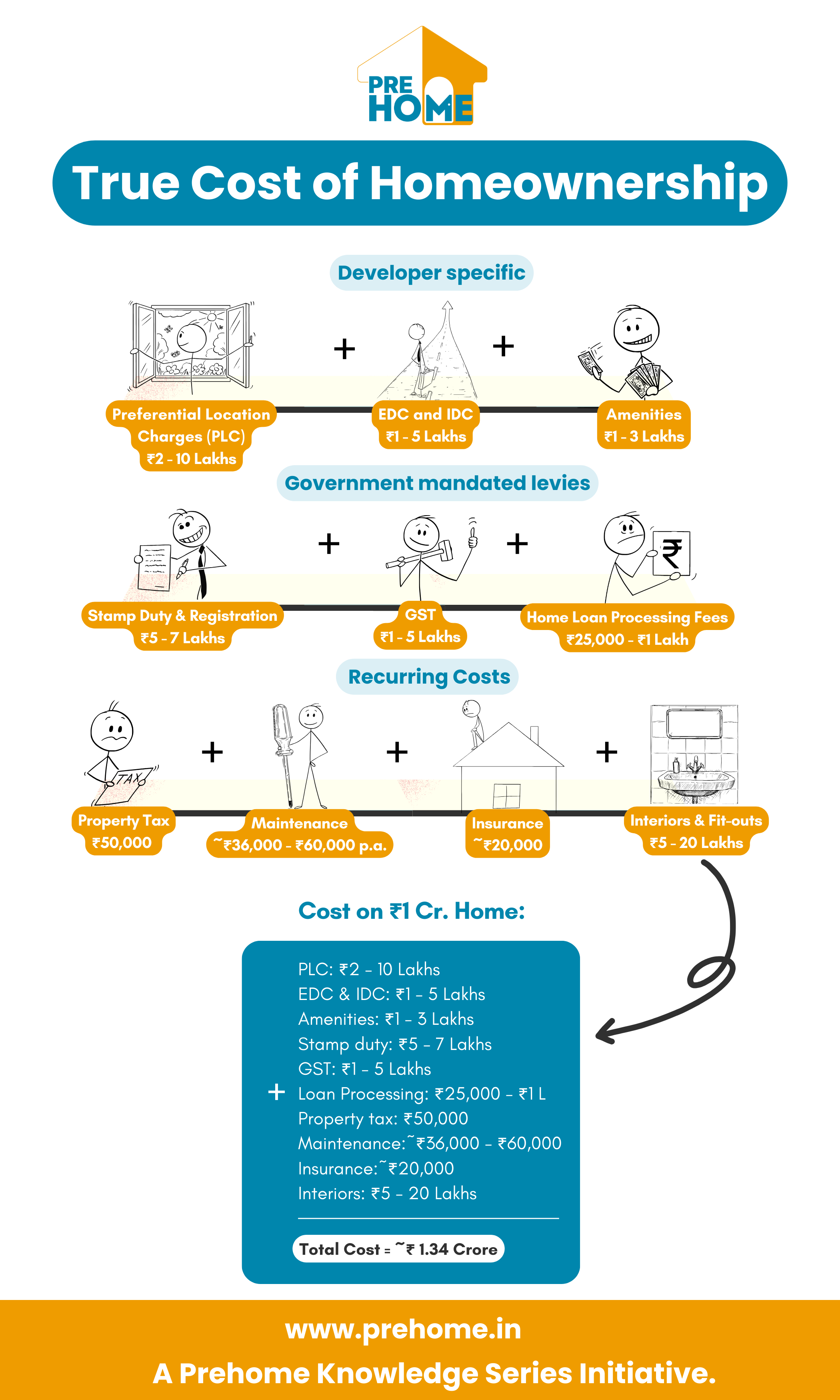

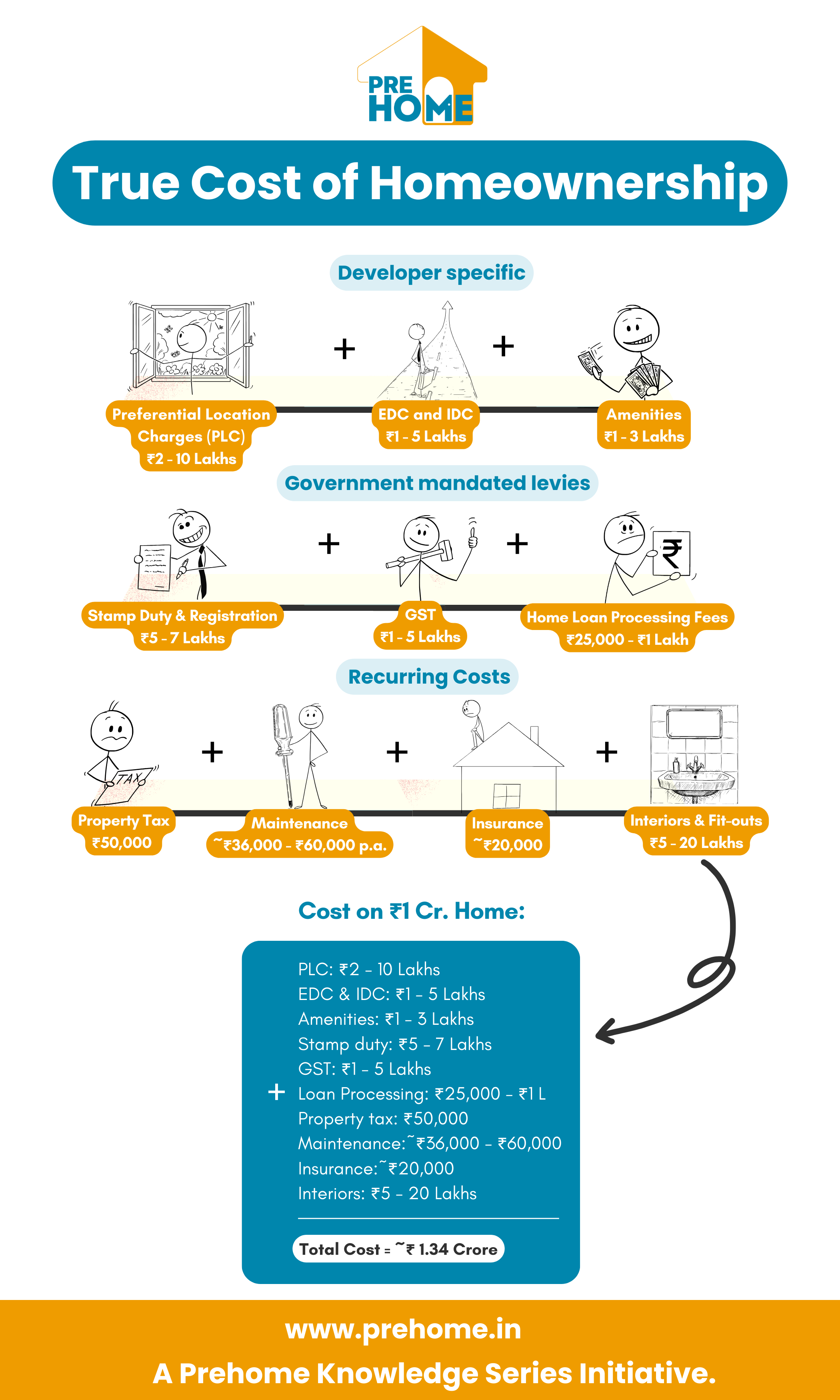

Category 1 : Developer-Specific and Creative Charges

These are fees that developers create to cover various services and amenities, often with very little transparency.

- 1. Preferential Location Charges (PLC) & Floor Rise Charges:

- These are premiums for a "better" unit. It could be a flat facing the park (PLC) or one on a higher floor (Floor Rise Charges). These are usually charged per square foot and can substantially increase your bill

- 2. Amenity & Club Membership Fees:

- This is a one-time fee for accessing a clubhouse, swimming pool, gym, and other facilities. Developers often bundle these fees, making it hard to opt out.

- 3. Parking Charges: A Legal Gray Area:

- This can be confusing and is a common area where developers add costs.

- Know Your Rights: In a landmark 2010 ruling, the Supreme Court of India stated that open and stilt parking spaces cannot be sold separately. These are part of the common areas and amenities. The cost for these should be included in the overall price of the flat.

- What Can Be Charged: The only parking space that can be legally sold as a separate unit is a fully enclosed garage.

- The Reality Check: Despite the law, many developers still charge a separate fee for parking, often calling it an "allotment fee" or "charge for usage rights." Be cautious and closely examine your agreement.

- 4. The "Miscellaneous" Charges:

- This is where developers can be quite creative. You might encounter fees with vague names like "Utility Connection Charges" for water and electricity or "Maintenance Deposit" collected upfront.

- Exposing the Hidden Fees: Other fees, such as "scan charges," "documentation fees," or "transfer charges" for re-booked units, show how developers find ways to increase the bill. Check every line item in your payment plan.

Category 2: Government-Mandated Levies

These are charges developers pay to government authorities and pass on to the buyer.

- 1. Stamp Duty and Registration Fees: The Legal Essentials:

- This is a necessary tax imposed by the state government to legally register the property in your name.

- Pro Tip: Stamp duty rates can vary a lot by state. For example, in Chennai, the rates differ from those in Mumbai. Always check the latest rates for your city.

- 2. EDC & IDC: The Cost of Community Infrastructure:

- EDC (External Development Charges) covers fees for infrastructure outside the project, like main roads and drainage systems.

- IDC (Internal Development Charges) is for infrastructure within the project, such as internal roads and electricity lines. These are often calculated per square foot.

- 3. GST (Goods and Services Tax):

- This applies to under-construction properties. The current rate is 5% for non-affordable housing and 1% for affordable housing.

- Did you know?: There is no GST on ready-to-move-in properties with a completion certificate. This is an important cost to consider when comparing options.

- 4. UDS (Undivided Share of Land):

- This refers to your fractional ownership of the land on which the building stands. It’s a crucial aspect, especially in apartment sales in many Indian markets.

- A Chennai Perspective:In cities where it’s common, UDS is registered separately from the construction agreement. A significant change in Chennai’s law requires a single sale deed, but the value of the UDS still factors into stamp duty and registration, affecting your total cost. It’s essential for your property's long-term value and compensation during redevelopment.

Category 3. The Recurring "Ongoing" Costs

After paying the one-time charges, these are the costs you need to budget for every year.

- Property Taxes: Your Annual Contribution to the City:

- Property Taxes: Your Annual Contribution to the City

- Maintenance and Society Charges: The Community Cost

- These ongoing costs support living in a community. They cover everything from security guards and lighting in common areas to garbage collection and lift maintenance.

- Home Insurance: The Safety Net

- While not always required, having a good home insurance policy is essential for protection against unexpected events like fire, natural disasters, or theft.

- Know your rights: Many home loan providers will require you to buy a policy from them. However, it is not legally necessary to purchase home insurance from your bank. You can choose any policy that offers better coverage or a lower premium.

- What to Do: Compare the bank's policy with others available. If you find a better option, you can buy it separately and provide proof of coverage to your lender.

Conclusion: Informed Decision Making

Buying a home is an exciting journey, and being informed is your best tool. Understanding these hidden costs isn't meant to discourage you; it’s about being ready and making a smart, confident choice. Focus on the total cost of ownership—from the initial one-time fees to the long-term ongoing expenses.

By knowing these charges, you can plan better and ensure your dream home doesn’t become a financial burden. It’s about building a solid understanding—a foundation we believe is crucial for every future homeowner.

Curious about how these costs compare to renting? Our next blog will provide a detailed side-by-side comparison. Stay tuned, or if you’re ready to explore a clearer and simpler path to homeownership, take the first step with us.